Developers

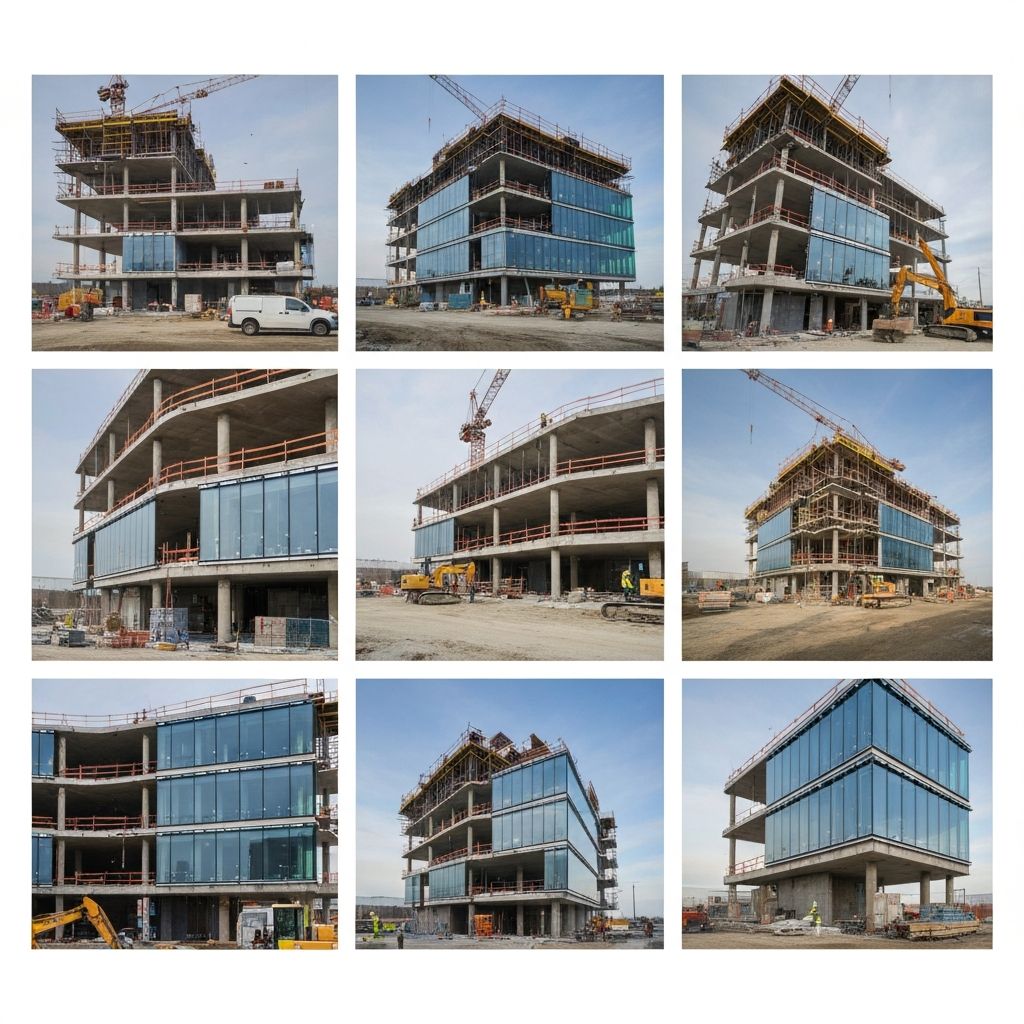

Ground-up construction financing, value-add refinancing, and repositioning projects.

Capital Markets Advisory Firm

Institutional-Grade Capital Solutions for Commercial Real Estate

Brookmont Capital Ventures is a capital advisory firm serving real estate developers and investors. We structure and source debt and equity financing including bridge loans, construction financing, DSCR loans, and capital stack solutions.

Brookmont partners with real estate sponsors, developers, and investors navigating complex capital needs and ambitious commercial development pipelines.

Ground-up construction financing, value-add refinancing, and repositioning projects.

Portfolio growth, investor refinance solutions, and real estate investment exits.

Commercial real estate loans for operating companies and investment platforms.

Affordable housing financing and community development projects.

CRE debt and equity advisory solutions including bridge loans, construction financing, DSCR investor loans, preferred equity, and capital stack advisory tailored to complex development strategies.

Construction, bridge, and refinance solutions, including CMBS and select agency partnerships.

Preferred equity, joint venture equity, and co-GP structures aligned with sponsor objectives.

Underwriting, feasibility, and institutional-quality deal packaging for lenders and capital partners.

Our team brings decades of experience structuring complex commercial real estate transactions. We combine institutional underwriting capabilities with boutique-level attention to ensure every real estate deal receives the focus it deserves.

With relationships spanning banks, debt funds, family offices, and institutional investors nationwide, we have the connections to find the right commercial loan providers for your project—regardless of complexity or location.

We leverage advanced financial modeling, market analytics, and institutional-quality deal packaging to position your real estate financing for success. Our streamlined process reduces time to close while maximizing execution certainty.

Modeled using lender-grade financial metrics, feasibility, and risk scoring.

100+ relationships across banks, funds, CMBS desks, and private capital.

From senior debt to equity waterfalls and structured recaps.

Clear milestones and execution-driven communication.

Ground-up multifamily project requiring optimized LTC and sponsor-friendly reserves. Secured competitive construction financing.

Value-add office repositioning with lease-up risk. Structured flexible bridge loan with extension options.

Mixed-use development needing gap equity. Partnered with sponsor on preferred equity with 12% return.

Stay ahead with our market insights, educational resources, and thought leadership on commercial real estate finance. We share knowledge that empowers sponsors to make better capital decisions.

Key considerations for developers seeking optimal construction financing in today's market.

How preferred equity is filling the gap between senior debt and common equity.

A comprehensive comparison of multifamily agency programs and their benefits.

Explore our comprehensive range of commercial real estate financing options

Short-term financing for immediate capital needs

Flexible debt capital for complex transactions

Commercial Mortgage-Backed Securities financing

New development and construction project financing

Debt Service Coverage Ratio financing